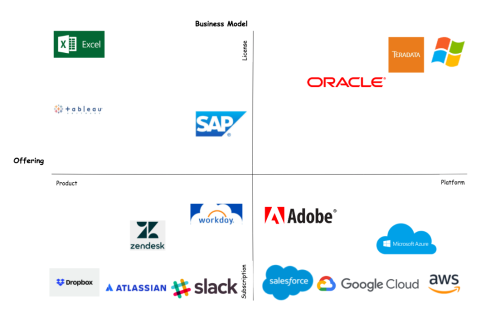

This post covers two axis in product positioning - product vs platform and licensed vs service. My goal is to help product leaders and companies think about where their offering really competes and what it means to win there.

Horizontal Axis: Product vs Platform

Products are discrete offerings where the key relationship is between the provider and the customer. Think Dropbox, Gmail, Excel.

- Innovation: Products win through profound understanding of the end-user persona (I just want all files to sync without ever thinking about it) and building the most seamless user experience for them. Products build moats around their existing user base, via data network effects or skill-set (e.g Excel as first spreadsheet reliant on GUI and a mouse)

- Distribution Channel: Products are distributed by a platform - Operating System, browser, app stores, public cloud. This is how users will discover and sign-up for the product. Deciding which platforms to support is key to balance distribution with trade-offs in customer relationship, cost, user experience.

Platforms are distribution channels where the economic value generated by participants in the ecosystem is higher than the value generated by the owner of the platform. Platforms enable partners to build entire business atop of them, only taking a tax. Think AWS, iOS, Browsers.

- Innovation: Platforms win by enabling builders with distribution and empowering them with capabilities to build winning products. The platforms that succeed long-term are able to amass a moat with the number of products available on the platform.

- Distribution Channel: Platforms are often built on top of other platforms. The web browser was built on top of Windows (and other Operating Systems). They need their own distribution means and just like other products must be thoughtful about the platform they are built on. Compare Salesforce thriving in Browsers with Flash dying when iOS dropped support.

Vertical Axis: Licensed vs Services

Licensed solutions are purchased once (sometimes in enterprise with an incremental per year fee). Think iPhones, Microsoft Office (pre 360), or Mainframes.

- Innovation: Licensed solutions must be implemented, maintained, and integrated. This cost means new products / upgrades must add significant capabilities to warrant the investment and incremental changes are hard. This means new versions must deliver substantial value in big releases. The criticality of planning in this approach led to Waterfall style project management.

- Distribution Channel: Licensed solutions are a “big” decision. To prove that ROI requires big sales & marketing channels. In enterprise winners achieved strategic advisor relationships with executives who control budget. CIOs led “Microsoft Shops”

Services solutions are purchased over time by subscription or by usage. Think Salesforce, Slack, or the Public Clouds.

- Innovation: Services solutions handle the implementation, versioning, and maintenance for you. Providers can incrementally add features and functionality over time. The competitive environment can innovate very quickly to meet client needs. The criticality of immediate responses led to Agile style development processes. The challenge in services is to constantly improve user experience without disruption.

- Distribution Channel: Services solutions are a “small” decision. They win by driving adoption and engagement. Often, the end user is the buyer. The most successful companies make their offering as easy as possible to initially adopt - creating a wedge with users - and then have systematic approaches to increase engagement and drive adoption.

Key takeaways

- Understand where your offering fits in to the market ecosystem and what that means for how you need to innovate and distribute

- Products must build on the right platforms balancing distribution and ability to deliver superior experience

- Platforms also are built on top of other platforms and need to achieve distribution and critical mass of products on them to win

My next post will take a historical perspective to where the enterprise market is today and how we got here.